Whether you’re trying to grow your window cleaning business, or just hang on in these challenging times, your credit may play an increasingly important role in your options for 2021 and beyond. Lenders are increasingly requiring good credit, among other qualifications, so maintaining good credit may be key to a thriving business in the future.

Here are 5 common credit mistakes that business owners often make and how to avoid them:

1. Failing to Monitor Personal Credit

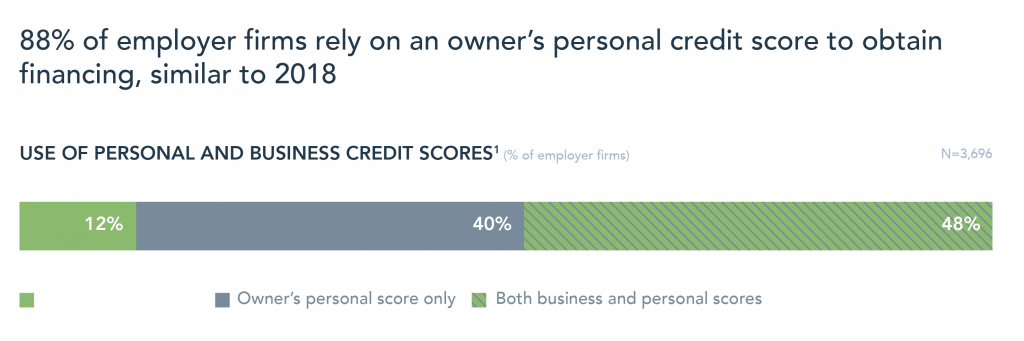

When business owners apply for financing it’s not unusual for lenders to check their personal credit. In fact, the Federal Reserve’s 2020 Small Business Credit Survey (SBCS) found that 88% of business owners used their personal credit when applying for financing. (Often that credit check results in a “soft inquiry,” that doesn’t affect personal scores.) And many business owners discovered the hard way that a good credit score was required to get a COVID-19 relief loan under the Economic Injury Disaster Loan (EIDL) program.

Source: Federal Reserve Small Business Credit Survey 2020

If you pay your bills on time, you probably assume you have good credit. But that’s not always the case. Several years ago my mortgage company reported me late six times in a row! I had not missed a payment during that time period, though, and had to dispute the error in order to get the auto loan I needed.

Fortunately there are many places where you can check and monitor your personal credit scores for free. It’s a good idea to make sure you are monitoring your credit with all three major consumer credit reporting agencies: Equifax, Experian and TransUnion. The three bureaus don’t share information with each other, and you never know for sure which one a lender will check. You can also get free copies of your credit reports from the federally mandated free credit report website AnnualCreditReport.com.

2. Overlooking Business Credit

Your business may have its own credit reports and scores; a fact many business owners often overlook. Because there is no requirement to get your permission before reviewing your business credit, you may not even realize this credit check is taking place.

A Nav survey found that business owners who understood their business credit were 41% more likely to be approved for a business loan.

Three major commercial credit agencies: Dun & Bradstreet, Equifax and Experian compile and sell credit reports on businesses though you may also come across the Small Business Financial Exchange (SBFE) which is a data warehouse, or other business credit agencies such as Creditsafe and LexisNexis.

Similar to your personal credit, this information may help you secure a small business loan or financing such as vendor or supplier credit. In fact, the Fed’s SBCS mentioned above found that 60% of applicants used a combination of business and personal credit or just business credit to get financing.

3. Doing Business With The Wrong Suppliers

There are many factors that go into choosing suppliers in your business. One to consider: do they offer net terms (such as net 30 or net 60) and then report those payments to business credit agencies? Doing so can be helpful in terms of building business credit, which in turn can help you secure longer net terms and/or other business financing such as lines of credit or term loans.

It never hurts to ask your vendors if they report. If not, consider doing business with a few that do report. (You’ll find a list at Nav.com/vendors.) And if your business extends payment terms to business customers, you can report their payments as well. It may help encourage them to pay on time!

4. Taking Whatever Financing You Can Get

Searching and applying for financing may be up there neck and neck with accounting as one of your favorite tasks in your business. Which is to say, you probably hate it.

Shopping for a small business loan is more complex than shopping for personal financing because:

There are many more types of financing options, Qualifications can be very different depending on what type you apply for, and There’s generally no requirement for the financing company or lender to provide an Annual Percentage Rate (APR) to compare costs.

Still, taking the time to explore all your options can save you a lot of money (and headaches) in the long run. If the offer you get does not list an Annual Percentage Rate, you can use a free business loan calculator to translate the cost to an APR so you can compare it with other options.

5. Not Using a Business Credit Card

If you’re mixing business and personal purchases, or using a personal credit card for your business, it’s time to consider getting a business credit card. When it comes to financing, most business credit cards report payment history to commercial credit reporting agencies, which helps you build business credit. And some do not report to personal credit bureaus unless you default. That helps you separate your personal and business credit and is especially important if you carry balances on your credit cards when cash flow is tight.

Keep in mind that most business credit cards also offer richer rewards than their consumer counterparts. Card issuers want small business customers because they tend to spend more.

One more thing to keep in mind: business debit cards don’t carry any protection under federal law if they are lost or stolen. Business credit cards do. Use your credit card like a debit card and pay off the statement balance in full to avoid interest while still reaping the benefits of rewards and superior fraud protection.

About the Author:

Gerri Detweiler been guiding individuals through the confusing world of finance and credit for 20+ years. She is the author or coauthor of five books, including her most recent, Finance Your Own Business: Get on the Financing Fast Track. Today, Gerri serves as the Education Director for Nav, an online platform that matches small business owners to their best financing options and gives free access to personal and business credit scores.

Gerri Detweiler been guiding individuals through the confusing world of finance and credit for 20+ years. She is the author or coauthor of five books, including her most recent, Finance Your Own Business: Get on the Financing Fast Track. Today, Gerri serves as the Education Director for Nav, an online platform that matches small business owners to their best financing options and gives free access to personal and business credit scores.